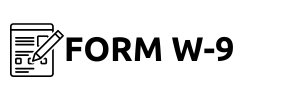

Printable IRS W-9 Form

IRS Form W-9 Essentials: Completing the Request for TIN

IRS Form W-9 is a critical document used in a wide array of financial interactions, primarily purposed for gathering information from individuals and entities with whom a business conducts transactions. This form requests taxpayer identification number and certification and is vital for maintaining compliance with IRS regulations. The significance of the W-9 form cannot be understated; it serves as a means for businesses to obtain accurate taxpayer information necessary for reporting income paid during the fiscal year.

The value of our website, w9-fillable-form.net, in this context, is immense. For taxpayers and businesses alike, understanding the intricacies of the IRS Form W-9 instructions is essential, and our website provides the necessary guidelines with detailed samples. The materials, such as step-by-step instructions and practical examples, allow users to fill out the W-9 request for taxpayer identification number confidently, knowing they have expert guidance at their fingertips.

The W-9 Tax Form Significance for Business & Contractors

When an individual or business entity engages in a financial transaction where income reporting to the IRS might be necessary, a W-9 form in PDF printable is often requested. The document serves as a formal request for taxpayer identification number and certification. You can print the W-9 form for free and have it ready for such instances, ensuring you're prepared to provide the necessary information. Luckily, a blank W-9 template in PDF can be accessed with ease from our website, enabling smooth business operations. This convenience is particularly useful for businesses that require this document from multiple contractors or service providers and seek to maintain organized financial records.

- Generally, the free printable IRS W-9 form is frequently used when one party requires confirmation of another party's taxpayer identity, such as in freelance work or with independent contractors. The business or payer uses the information to report income paid to the IRS, usually with the 1099-MISC copy.

- Another common requirement for the IRS printable W-9 form for 2024 arises in the banking sector, where it is utilized to obtain information for interest, dividend payments, or similar financial transactions that might require tax reporting at the end of the year.

Filling Out the Blank W-9 Template for Print

Understanding the free printable blank W-9 form is important for anyone who engages in taxable transactions as a payer or payee. The template includes crucial sections that need to be addressed accurately. Among these are the requester's information, which identifies who is asking for your personal data, and the taxpayer identification number (TIN), a critical piece of data for tax reporting purposes.

IRS Tax Form W-9 for 2024: Key Points

The accuracy of completing the blank printable W-9 form for 2024 can prevent future tax-related complications. Key information such as your full name, business name (if applicable), tax classification, and TIN must be provided clearly and precisely. Making sure to review the IRS Form W-9 in a printable PDF format before filling it out can also be a helpful step to ensure no important field is missed or filled out inaccurately.

File a W9 Copy on Time

The due date to file a W-9 form with the requester is typically upon request or as specified by the requester. Unlike tax documents such as W-2 or 1099, the W-9 itself is not filed with the IRS. Instead, it is provided directly to the entity that needs your taxpayer identification information for reporting purposes. When a requester asks you to complete a W-9, they will usually provide a deadline or specific timeframe within which they require the form to be submitted. This timeframe is determined by the requester's internal processes, reporting schedules, or other organizational requirements.

Federal Form W-9 & Related Penalties

The implications of submitting a free printable W-9 tax form are significant - accuracy and honesty are paramount. Providing false information, whether inadvertently or deliberately, can result in severe penalties, audits, or tax evasion charges. Additionally, refusing to provide a W-9 when it is lawfully requested can lead to withholding taxes at the highest rate, causing financial inconvenience.

W-9 Printable Template: Answering Your Questions

Additional W-9 Form Instructions & Samples

Please Note

This website (printable-w9-form.org) is an independent platform dedicated to providing information and resources specifically about the W-9 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.